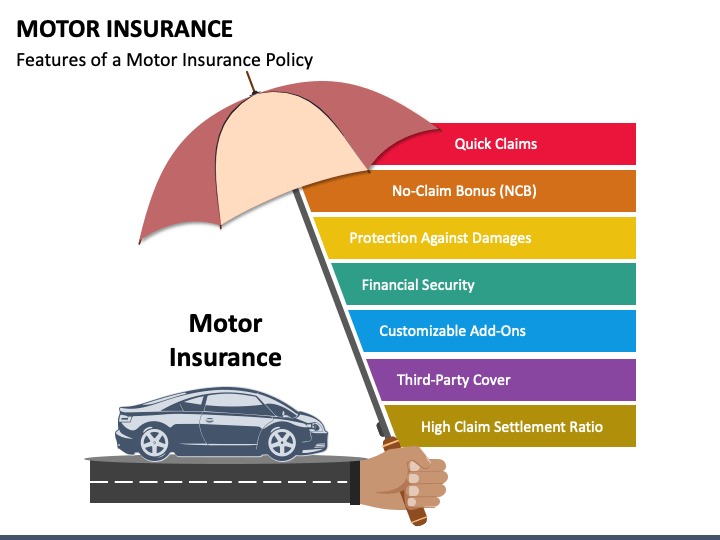

MOTOR INSURANCE

Costs involved in fixing the car, other property or another driver's car. Car and auto insurance is essential for all drivers and is required by the law. It is wise to have full coverage automobile insurance, but some drivers can get only third-party or liability insurance.

There are several types of auto insurance. These include:

- Full coverage auto insurance: In the event of an accident, full coverage auto insurance will protect the car and any other cars or property damaged. Normally, finance companies stipulate that any of their clients that have car loans must insure their cars fully. This protects the bank, as the car is theirs until the loan is paid off by the owner.

- Third party auto insurance: Third party or liability auto insurance will only protect another party in the event of an accident. So if a car with third party auto insurance hits another car, the other car's damages, and perhaps even the expenses incurred from loss of use, would be paid by the offender's third party insurance. However, any damage to his/her own car would have to be borne by the car owner. Naturally, this is less expensive than full coverage, as it carries far less risk.